In today’s fast-paced, digitally-driven world, accessing your financial accounts quickly and securely is crucial. For members of Digital Federal Credit Union (DCU), the DCU online login is more than just a way to check your balance—it’s your command center for managing every aspect of your financial life. From making payments to transferring funds and applying for loans, the DCU online login provides the tools you need to navigate your finances with ease.

This article will take you through everything you need to know about DCU’s online login system, from accessing your account to troubleshooting issues, and offer insights into how to maximize your use of this powerful financial tool.

1. Understanding the Power of DCU Online Login

The DCU online login is your all-access pass to the world of Digital Federal Credit Union’s digital banking services. Whether you’re managing a checking account, paying off a loan, or keeping track of your investments, the login portal gives you the ability to control your finances from anywhere, at any time.

Key Benefits of DCU Online Login:

- 24/7 Access to Your Accounts: No need to wait for business hours. Manage your accounts whenever it’s convenient for you.

- Real-Time Fund Transfers: Move money between accounts or to external financial institutions with ease.

- Bill Payment: Pay bills directly from your account without needing to write checks or visit a branch.

- Loan and Credit Card Management: Check balances, review payment schedules, and manage credit lines all in one place.

Once logged in, you’ll discover that the platform is not just functional, but designed to help you stay on top of your financial goals.

2. How to Log In to DCU Online: A Step-by-Step Guide

Gaining access to your DCU online account is simple, but it’s important to follow the right steps to ensure your information remains secure. Here’s how to do it:

Step-by-Step Login Instructions:

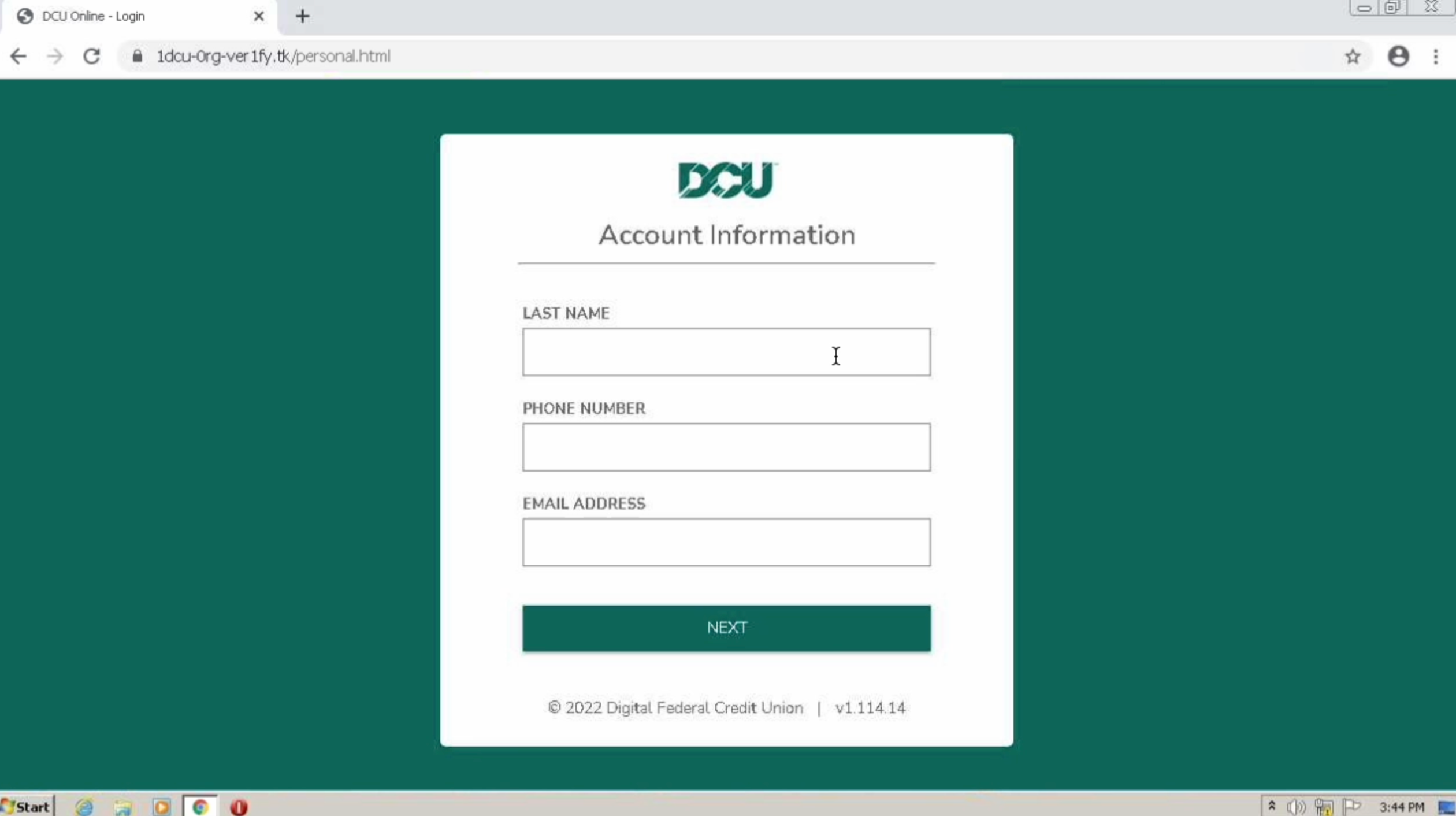

- Visit the Official DCU Website

- Go to dcu.org. Always ensure you are visiting the official website to avoid phishing scams or malicious sites.

- Find the Login Section

- On the top-right corner of the homepage, locate the “Online Banking Login” section. This is your gateway to accessing your account.

- Enter Your User ID

- Input the User ID you created when you first opened your DCU account. Make sure this is correct, as multiple failed attempts can temporarily lock your account.

- Enter Your Password

- Type in your secure password. Ensure it’s a strong, unique password to keep your account safe from hackers.

- Enable Two-Factor Authentication (2FA)

- For added security, you’ll be prompted to enter a two-factor authentication (2FA) code sent to your phone or email. This is an extra layer of protection that helps prevent unauthorized access.

- Click “Login”

- After entering your credentials, simply hit “Login.” You’ll now be inside your DCU online account, with full access to all banking tools.

3. Unlocking Features Inside DCU Online Banking

Once logged in, you’ll discover that the DCU online portal offers a wide variety of features designed to streamline your financial life. Here are some of the most useful tools you can access:

Account Overview

Your account dashboard provides an at-a-glance view of all your financial accounts. You’ll see balances for checking, savings, credit cards, loans, and even investments. This centralized view helps you stay on top of your finances without switching between platforms.

Transfers and Payments

- Internal Transfers: Instantly move money between your DCU accounts—whether it’s checking to savings or vice versa.

- External Transfers: Need to send money to another bank? No problem. You can set up external transfers to make the process easy.

- Bill Pay: DCU’s bill pay feature allows you to set up automatic payments for recurring bills, such as utilities, rent, or credit card payments. This ensures you never miss a payment deadline.

Loan Management

For members with auto loans, personal loans, or mortgages through DCU, the loan management tools allow you to:

- View loan balances and payment schedules.

- Set up automatic payments to ensure timely transactions.

- Explore refinancing options directly from your dashboard.

Investment Tracking

If you have investments with DCU, the online banking system provides tools to monitor performance, adjust allocations, and keep tabs on your overall portfolio—all in real time.

4. Security Features: Keeping Your DCU Online Login Safe

With the increasing prevalence of cyber threats, security is a top priority for Digital Federal Credit Union. Here’s how DCU ensures that your account and personal information remain secure:

Multi-Factor Authentication (MFA)

After entering your password, DCU’s MFA system requires an additional code to verify your identity. This code is typically sent to your phone via SMS or email, ensuring that even if someone has your password, they can’t log in without the additional verification step.

Encryption

DCU uses SSL encryption to secure all communications between your browser and its servers. This means that any data you send or receive is protected from unauthorized interception.

Fraud Alerts and Monitoring

DCU’s system constantly monitors your account for suspicious activity. If any unusual transactions are detected, you’ll receive an immediate alert, allowing you to act quickly to secure your account.

Account Alerts

You can set up customized alerts to notify you of significant account activity, such as large transactions, low balances, or payment reminders. These alerts are delivered via text or email, so you’re always in the loop about what’s happening with your finances.

5. Troubleshooting DCU Online Login Issues

Even the most secure systems can have occasional hiccups. If you ever encounter issues with your DCU online login, here are common problems and solutions to help you resolve them quickly.

Forgotten Password

- If you forget your password, simply click on the “Forgot Password?” link on the login page. DCU will guide you through the process of resetting your password by sending a verification code to your email or phone.

Account Locked

- If you enter the wrong password too many times, your account may be temporarily locked for security purposes. To unlock your account, you’ll need to contact DCU Member Services via phone or live chat to verify your identity and regain access.

Two-Factor Authentication Issues

- If you’re having trouble receiving your 2FA code, double-check that your contact information (email or phone number) is correct. If you’re still not receiving the code, try using an alternative method (like email instead of SMS) or contact customer support for assistance.

6. Take DCU Online Banking On the Go: The Mobile Experience

DCU’s online banking platform isn’t limited to desktop use. With the DCU mobile app, you can manage your finances from anywhere, giving you even greater flexibility.

Key Features of the DCU Mobile App:

- Mobile Check Deposit: Snap a picture of a check with your phone’s camera and deposit it directly into your account—no need to visit a branch.

- Biometric Login: Use fingerprint or facial recognition to quickly and securely log into your account, eliminating the need for manual password entry.

- Push Notifications: Stay on top of your finances with instant notifications for account activity, including deposits, withdrawals, and bill payments.

Available for both iOS and Android devices, the DCU mobile app provides a seamless banking experience wherever you are.

7. Maximize Your DCU Online Banking Experience

Once you’re familiar with the basics, there are several advanced features within the DCU online login that can help you take your financial management to the next level.

Credit Score Monitoring

DCU offers an integrated credit monitoring service that lets you check your credit score directly from your account dashboard. You’ll also receive personalized tips on how to improve your score and keep your financial health in top shape.

Automated Savings

DCU allows you to set up automatic savings plans, where a portion of your income or transactions is automatically transferred to your savings account. It’s an easy way to ensure that you’re consistently building your savings without having to think about it.

Paperless Statements

Switch to paperless statements to receive all of your account information digitally. It’s eco-friendly and ensures you have instant access to your statements without waiting for the mail.

8. Conclusion: Why the DCU Online Login is Your Essential Financial Tool

The DCU online login isn’t just a way to check your balance—it’s a complete financial management system. With robust features for everything from bill pay and loan management to investment tracking and real-time alerts, it’s a platform that puts you in full control of your money. Whether you’re logging in from a desktop or on the go with the mobile app, DCU ensures that your banking experience is smooth, secure, and designed to help you reach your financial goals.

If you haven’t yet explored all that DCU online banking has to offer, now is the time to log in and take full advantage of this powerful tool.