In the competitive landscape of forex trading, staying ahead requires not only knowledge and experience but also access to timely and accurate market information. Forex signals serve as a valuable tool for traders seeking to enhance their strategies and achieve profitable outcomes. In this article, we will explore what forex signals are, the benefits they offer, how to choose the best providers, and practical ways to integrate them into your trading routine.

1. What Are Forex Signals?

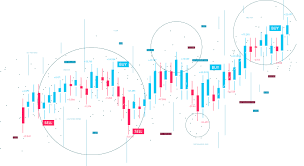

Forex signals are alerts or recommendations that indicate potential trading opportunities in the foreign exchange market. These signals can be generated manually by experienced analysts or automatically by trading algorithms. Typically, forex signals include:

- Currency Pair: The specific pair of currencies to trade (e.g., USD/JPY).

- Action: A recommendation to buy (long) or sell (short).

- Entry Price: The ideal price level to enter the trade.

- Stop-Loss Level: A price point to limit potential losses.

- Take-Profit Level: The price at which to exit the trade for a profit.

By following these signals, traders can make informed decisions that align with market trends and dynamics.

2. Benefits of Using the Best Forex Signals

Integrating quality forex signals into your trading strategy can provide numerous advantages, including:

A. Improved Decision-Making

Forex signals are typically based on thorough market analysis, incorporating technical indicators and fundamental analysis. This can help traders make more informed decisions and reduce the emotional bias that often affects trading outcomes.

B. Time Efficiency

Monitoring the forex market can be time-consuming and overwhelming, especially for traders managing multiple currency pairs. Forex signals save time by providing ready-to-use recommendations, allowing traders to focus on executing trades rather than conducting extensive analysis.

C. Enhanced Accuracy

Many reputable forex signal providers boast high success rates due to their rigorous analytical methods. By following these expert recommendations, traders can improve their chances of making profitable trades.

D. Effective Risk Management

Most forex signals come with predefined stop-loss and take-profit levels. Implementing these levels helps traders manage risk effectively, ensuring that losses are kept to a minimum while securing profits.

3. Choosing the Best Forex Signals Provider

Selecting a reliable forex signals provider is crucial for maximizing the benefits of trading signals. Here are some key factors to consider:

A. Performance Track Record

Look for a provider with a proven performance history. Key indicators of reliability include:

- Win Rate: Aim for providers with a win rate of at least 70%.

- Transparency: The provider should openly share past performance data, allowing you to verify their claims.

B. Reputation

Research the provider’s reputation by:

- Reading Reviews: Check online reviews and testimonials from current or past users.

- Community Engagement: Participate in trading forums to gather insights about the provider’s reliability and performance.

C. Analysis Methodology

Evaluate how the signals are generated:

- Technical and Fundamental Analysis: A good provider should utilize both technical indicators and economic news in their analysis.

- Automated Systems: If using algorithms, ensure they are based on sound trading principles.

D. Delivery Methods

Timely delivery of signals is essential:

- Notification Channels: Providers should offer alerts through multiple channels (SMS, email, app notifications).

- Real-Time Updates: Signals should be updated to reflect the most current market conditions.

4. Top Providers of Forex Signals

Here are some of the best forex signals providers known for delivering reliable and effective signals:

A. ForexSignals.com

ForexSignals.com offers a comprehensive range of signals supported by a community of traders. Their platform includes live trading rooms, educational resources, and a strong focus on user engagement. Subscribers receive signals via SMS and email, making it easy to stay informed.

B. MQL5 Signals

MQL5 Signals is part of the MetaTrader platform and allows traders to subscribe to signals from experienced traders. The service provides performance statistics, enabling users to choose signal providers based on success rates and trading styles.

C. Toro

Toro is a popular social trading platform that enables users to follow and copy the trades of successful traders. The Copy Trader feature allows users to replicate trades automatically, making it suitable for both beginners and experienced traders.

D. 1000pip Builder

1000pip Builder focuses on delivering accurate forex signals for major currency pairs. Their signals come with detailed explanations and risk assessments. Subscribers receive alerts via email and SMS, ensuring timely information.

E. DailyForex

DailyForex provides a mix of free and premium forex signals generated by professional analysts. Their user-friendly platform and commitment to transparency make it easy for traders to access high-quality signals.

F. Zulu Trade

Zulu Trade is a social trading platform that connects traders with signal providers. Users can follow and copy the trades of professional traders based on performance metrics and risk levels. This platform offers automation features, allowing traders to manage their investments passively.

5. Integrating Forex Signals into Your Trading Strategy

To maximize the benefits of forex signals, consider the following strategies:

A. Use Signals as a Supplement

Treat forex signals as a valuable tool rather than a crutch. Combine them with your analysis and trading plan for more informed decision-making.

B. Practice on a Demo Account

Before trading with real money, use a demo account to practice executing trades based on forex signals. This will help you familiarize yourself with the signal provider’s recommendations and build confidence in your trading approach.

C. Keep a Trading Journal

Document all trades executed based on signals, including entry and exit points, profits, and losses. Reviewing this data can help you identify patterns and refine your trading strategy over time.

D. Implement Risk Management Strategies

Always use risk management techniques when trading based on signals. Set stop-loss orders to protect your capital and avoid risking more than a small percentage of your trading account on a single trade.

E. Stay Informed About Market Developments

While forex signals provide valuable insights, staying updated on economic news and events is crucial. Major announcements can significantly impact currency prices, so being informed will enhance your trading decisions.

6. Conclusion

Enhancing your trading strategy with the best forex signals can significantly improve your trading performance. By choosing a reputable provider, you can access valuable insights that help you make informed trading decisions, manage risks effectively, and save time in the analysis process.

The benefits of using quality forex signals—such as improved decision-making, increased accuracy, and effective risk management—make them essential tools for traders of all experience levels. By integrating these signals into your trading routine, you can unlock your potential for consistent success in the forex market. Embrace the power of forex signals and take your trading strategy to new heights!